Your cart is currently empty!

Download Fake USDT Transfer App + Activation Code 2023 version

As a software development company in the development of Hacking Tools, we’ve decided to unveil our Fake USDT Sender Software. One of our finest software that puts you one step ahead of others. While developing the FAKE USDT Software we had one primary goal in mind. Have fun or make money. These two reasons are our driving force because our Fake USDT Generator Software is meant for pranking family and friends or for making money by sending Fake USDT to clients. Whichever way or reason you are getting this software is up to you.

This FAKE USDT SENDER is 100% unique and working. You can basically send as much USDT as you wish depending on your target and how much you wish to make in form of fiat from your client.

The Fake USDT Sender is under the same category as Coinceller and many others you might have come across. After studying what our competitors are doing out there, we decided to make sure we beat them by developing something unique with a great user experience.

While developing the Fake USDT Wallet Generator, we had our buyers in mind by making sure that it is user-friendly, Easy to use, and with great UX for easy navigation.

Disclaimer: While trying to contribute our own quota in the hacking world, we’re also concerned about the use of our software. This is why we have no control over what you do with the software. But whichever motive or reason behind why you intend to use the Fake USDT software, we’re not responsible for that action. The aim of this software is for educational purposes only.

With that all said, let us dive into the main important things you need to know about our Fake USDT Sender or Fake USDT Generator, whichever way you choose to put it.

FAKE USDT GENERATOR SOFTWARE

The Fake USDT Generator is making so many waves in the hacking industry and this alone has increased the demand for this software. how to make fake usdt transaction, you can basically send as much USDT as wish depending on what you have in mind to achieve. This USDT being sent out is Fake. This is why it is regarded as Fake USDT because despite it being displayed in the wallet of the receiver, it has no real-life market value. Therefore it can not be exchanged because it is just a flash fund.

with the Fake USDT Sender, you don’t need to be a guru or an expert in hacking and cryptocurrency. All you need to know is a basic knowledge of cryptocurrency and how it works.

If you’re new to cryptocurrency and you’re having a shallow understanding of how to make fake usdt transaction, then stick to this article as we’re going to break down everything that will put you on the right track.

We’re very much aware that a lot of newbies are finding it difficult to get into cryptocurrency or even understand it, but that doesn’t stop anyone from taking advantage of it.

By the end of this article, you’ll know how to make fake usdt transaction and download it without any stress. The download of the Fake USDT Sender comes with full Software + Activation Key. So keep reading as you learn more.

Before we talk about the FAKE USDT SENDER and how the FAKE USDT GENERATOR works, let me explain Tether as a coin for you to have a better understanding.

What Is USDT?

USDT is also regarded as STABLE COIN. It is a cryptocurrency that is used as a means of purchasing other coins, this is why it falls under the category of Stable Coin.

The coin has been one of the most adopted coins in the cryptocurrency industry, making it one of the most sort after coins in the market.

The USDT is pegged to the United State Dollars and also pegged 100% by the Tether Reserves.

The USDT which is also known as the Tether has been in existence for almost 8 years now as at the time of writing this article. The Coin was introduced in July 2014 and was officially introduced by iFinex, a registered company in Hong Kong. This company is also owned by BitFinex.

When the coin was introduced, in 2014, the was known as REAL COIN but later rebranded into Tether in November 2014.

In February 2015, the coin officially started trading and became one of the most used coins for purchasing other Altcoins due to its stability as a result of it being pegged to the USD.

With time Tether now supports Bitcoin’s Omni and Liquid protocols as well as the Ethereum, TRON, EOS, Algorand, Solana, OMG Network, and Bitcoin Cash (SLP) blockchains.

Fake USDT Sender (What You Need To Know)-Explained

Our Fake USTD Sender or Fake USDT Generator is an advanced software designed by our team of developers with the latest blockchain technology. The software is a 21st-century technology designed to hack into any complex blockchain advanced technology with one goal in mind, to send Fake USDT coins to any address or any wallet.

We designed the Fake USDT Sender in such a way that when the coin is sent out to the wallet of the victim or client. The victim will receive it as a real coin but one thing that is certain is that the victim can not send out the coin to any wallet because they are not real or legit.

Despite how powerful our fake USDT software is, we try to make it affordable to anyone interested in hacking and manipulating the cryptocurrency industry.

A lot of people are not aware of the Fake USDT sender software. Only a few people who were privileged to get their hands on our amazing software have benefited from the wonders it can do.

At first, when the software was released to the public, we were more concerned about how it might disrupt the crypto industry, drawing too much attention to us. So due to that, we decided to limit the number of people who could use the software.

At some point, we decide to make it accessible by ensuring that we make our terms of use clear to anyone using it to hack into any blockchain technology and send out phony USDT coins to users.

How Flash USDT Sender App Works

Our Fake USDT Software is one of the best out there, this is why you see a lot of blogs and bloggers recommending our software.

If you’re the type who has little or no knowledge about how the software works, then keep reading as we reveal everything you need to know about the Fake USDT Sender.

At the development level, a lot was put into the development. This is why the price is a little bit on the high side.

We’ve seen a lot of people claiming to have our Fake USDT Software. Most of them might be nulled which might have only a 17% success rate.

Once you buy the software directly from our company, you get special and exclusive access to this software.

How to generate fake usdt?

Our Fake USDT Sender or Fake USDT Generator is a lightspeed blockchain technology software. With the software, you can basically send out any amount of USDT to any wallet of your choice at lightspeed.

The Fake USDT Transfer App is designed in such a way that it forcefully injects or sends out flash USDT funds into the account of the victim.

When this transaction occurs, it leaves no traceable evidence in the blockchain. This means that there is no way the sender can be traced.

Our Fake USDT Software works more like a virus that is sent to the address destination of the victim. This is possible through the injection of the virus into recent existing transactions into the wallet of the victim in other to create an impression that actual funds have been sent to the address.

One thing we realize over the years about people parading themselves as hackers with access to our Fake USDT Sender software is that their own nulled version of Fake USDT Sender has only a 17% working probability as I have mentioned before. However, besides that, there are other things this software might be carrying.

How to send fake usdt to trust Wallet or Blockchain

Below are some of the disadvantages of using a nulled version of Fake USDT Sender Software gotten from public forums and nulled software owners.

Some Nulled Version Have Malware Possibilities

I’m very sure you’re much aware of what malware is. Just in case you don’t know what malware is, let me explain.

Malware is any software that is intentionally designed to disrupt a computer, Server, Client, or even a computer network with the sole aim of destroying, corrupting data, leaking private information, and gaining access to information or system. When this happens, it disrupts and deprives users of access to information, or unknowingly interferes with the user’s computer’s security and privacy.

When they offer you our software at a cheaper rate, they basically have one aim in mind. To disrupt your device.

These individuals might be pro hackers, developers, or even software engineering experts.

With their level of technical skills and level of hacking, they can easily infect your platform and device. This alone can create a loophole. This is why you see big cryptocurrency companies like Binance, Kucoin, Trust wallet, Latoken, and other big crypto companies doing everything possible to ensure that they stop these hackers from disrupting their security. Blockchain developers keep upgrading their technology to ensure that there are no loopholes that can give hackers access to their coins.

What we do is simply inject flash coins into the wallet of the victim. This has no security implications. It only uses an already existing transaction in the blockchain and then injects that into any address you enter while using the software.

Nulled Software Will Not Have a Great Wallet Address Effect

The Fake USDT Sender uses advanced technology that has the ability to fake usdt on trust wallet. When you have a nulled version of our software, there is every possibility of your wallet being vulnerable. This is why we always advise people to buy directly from us.

Our fake USDT Generator software, it simply infuses the flash into the address of the victim. This coin will last longer in the wallet of the victim. With this, no matter the complexity of the wallet or crypto company platform, our advanced software finds a way to manipulate the technology in other to successfully inject the flash coin into the address.

We ensured that the coin lasted for some time in other to make it look real before vanishing away. Our Fake USDT Generator software has the upper hand over competitors out there because it has the ability to manipulate wallet figure and add it properly to the address no matter how complex the security of the exchanger of the victim is.

Note: Our candid advice to you is to always tell your victim to provide a Trustwallet USDT address in other to send the coin out. With our software trust wallet proves to be the weakest exchanger that is easily hacked, but Binance will only take some time before being cleared by its security.

What Are The Features Fake Tether Usdt Sender Software?

The fake USDT sender or fake USDT generator is designed in an amazing way to create the impression that a transaction has occurred in the blockchain. Our Fake USDT sender app or software comes with premium features that allow even a novice with no knowledge of hacking to send out fake USDT and cash out like a professional hacker.

We ensured that a lot was put into consideration in other to meet our customer’s tastes by ensuring that we give top-notch market technology that comes with mind-blowing features making it one of the best Fake USDT Sender Apps out there.

Below are some of the features of the fake USDT sender

- Users can send up to $500k in flash USDT tokens per day.

- Users can transfer from one wallet to another

- The software price is affordable

- Supports all USDT wallets

- Mobile and PC versions are available.

Besides the feature highlighted in the bullet. Let us look at other amazing features that were considered during the development process of the Fake USDT Sender.

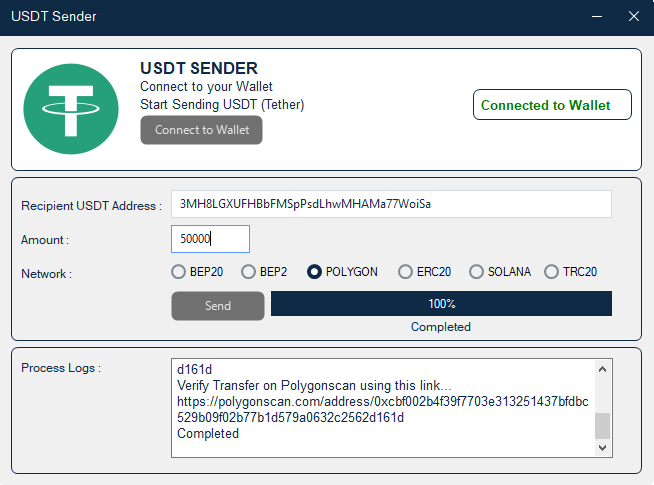

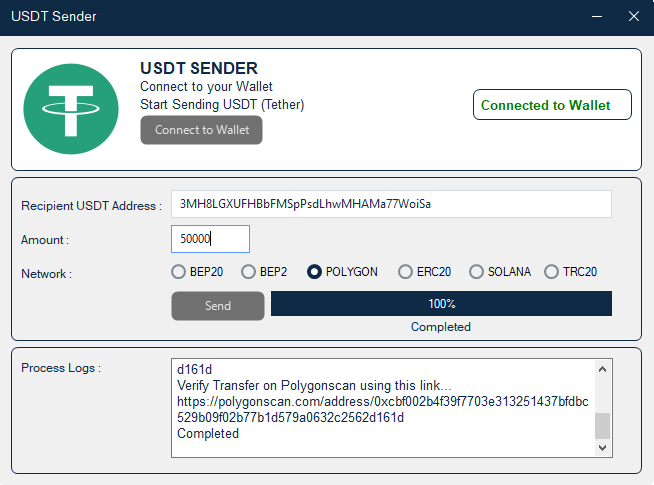

Great UI/UX Design

When we were in the development stage, our UI/UX was one thing we took our time to make top-notched. We know that a lot of developers don’t give much attention to UI/UX during development so long as their software does the job. But our case is different.

We ensured that we give it the best UI anyone could ever wish for. The APK version of our app has a great design and easy navigation that complement its practical working ability.

Light Speed Flashing

our fake USDT sender is a lightspeed software. We ensure that it operates at a high-speed capability in other to aid a smooth and easy working experience for our users. With this fast light-speed flashing technology, the malware that is sent out in form of a real USDT delivers into the victim’s wallet at the speed of light, making it one of the fastest Fake USDT Senders out there.

When the coin drops in the victim’s account, the technology manipulates the exchange system, deposits the money sent from the Fake Tether Transfer App into the victim’s wallet, then disappears or vanishes at a stipulated time frame.

This time frame is not certain because each exchange platforms are different. It is left for you to know how to retrieve the value you sent from our Fake USDT Sender in form of Fiat.

Multiple Wallet Net Work

Our Fake USDT Sender or Fake Tether Sender App sends out flash coins very fast and efficiently.

You can send to different popular wallets through our fake USDT Sender App. We are also updating different support capabilities for different wallets by ensuring we get hold of every loophole we find in their system.

40 Days Flash Duration

Despite the strong security from different exchangers, we’re able to find a way to make the coin last up to 40 days in the wallet of the victim. We believe that this time frame is enough to convince the victim that the fake coin is a legit coin. After that period, the coin will vanish.

Non Traceable

The Fake USDT Sender app transaction is anonymous, making it impossible to be tracked by anyone with advanced technology.

The Coin Cannot Be Traded

The coin sends from our software is not tradeable. But you can send or receive as many coins as you wish without any issues.

How To Install and use Fake USDT Transfer App | Fake Tether Sender App | Fake Tether sender

To install the fake USDT generator app/ software, you don’t need to be techy and a pro hacker. All you need is basic computer operation knowledge.

To install the fake USDT fake generator app, perform the following steps:

Step 1

You’ll need to purchase the Fake Usdt Generator App/Software from the main developers of the app at Fakeusdtsender.com

Step 2

Once you make payment and your payment is confirmed, you’ll receive a zip file that contains the software which you’ll need to unzip using Win Rar software.

Step 3

Unzip the files, run them on your device, then choose the network, enter the destination wallet, and the fake USDT transaction will be sent instantly through the fake tether sender app

Where To Download Fake USDT Transaction Generator/ Fake USDT Transfer App Free Download

The Fake USDT App can be found anywhere on the internet, but most of them are fake or have no activation keys to validate the Fake USDT Generator.

If you want to follow through other channels, you may be asked to perform some tasks such as completing surveys and other actions. But at the end of everything, you’ll not get the software as promised.

In other to get the original version of the Fake USDT transfer software, you’ll need to buy it from us, the original developers at https://fakeusdtsender.com/shop/.

Our website is the only and most trustworthy place on the internet to purchase the app.

Over the years, we’ve remained the most dependable source of Fake USDT Generator software and apps online over the years. What are you waiting for? Grab a copy of your Fake USDT Sender or Fake USDT Generator App Now.

How To Purchase And Download Fake USDT Transfer App + Activation Code 2023 Version

To purchase our Fake USDT Transfer App, you’ll need to visit our shop page to make a payment. Once you make payment, you can automatically download the Fake USDT Transfer App + Activation Code 2023 Version.

How To Get The APK Version Of Fake USDT Transfer App + Activation Code 2023 Version

FOR THE UPDATED VERSION OF THE SOFTWARE WITH PROOF, CONTACT US (FAKEUSDTSENDER) ON WHATSAPP.

+371 26 482 614.

Note: Ensure You Provide Proof Of Payment when contacting us.

FAQ On Fake USDT Transfer App Free Download

Is Fake USDT Transfer App Free Download?

The Fake USDT Transfer App is not available for free download but you can get it for an affordable rate from https://fakeusdtsender.com/shop/

What is a Fake USDT Wallet Generator?

A fake wallet generator is the same as a Fake USDT Sender, Fake USDT Generator, and Fake Tether Sender. The app allows you to carry out a fake transfer of USDT.

What Is The Transfer Limit For Fake USDT Transfer App?

The Fake USDT sender app allows you to send up to $500k worth of flash USDT Funds daily. Once you reach that limit you can’t send out more. You’ll have to wait for 24 hours again before you can continue.

Is The Fake USDT Transfer App Legit?

Yes. The Fake USDT transfer app is legit and it allows you to send out flash funds of up to $500k. We’ve embedded advance codes and strings that will give you a 99.99% success rate for any transfer that you initiate.

Can I Be Tracked If I Send Out Funds Using a Fake USDT Transfer App

The transfers that occur through the Fake USDT Generator App cannot be tracked because it is a flash fund that is injected into the wallet to create the impression that a transaction has occurred. This is because it is more like a virus and not an actual transaction that occurs on the blockchain network. If you perform any transfer, there is no possibility of you being tracked.

Conclusion

If you encounter any challenges while trying to access the app, you can contact us through our customer support channel. We’re always available to assist you with any challenges you may encounter.

If you have any questions or inquiries, you can drop them in the comment section. We’ll try to respond to them as fast as we can.

Posted

in

by

Comments

4 responses to “Download Fake USDT Transfer App + Activation Code 2023 version”

I used my fakeusdtsender Software I bought from you people to send usdt from my windows everything was really smooth but you need to make make the software user friendly please.

[…] How fake usdt works […]

I am extremely satisfied with the USDT sender software. It’s user-friendly interface and fast transaction speeds make sending money a breeze. Highly recommend!

[…] the flash usdt sender software on your device to generate fake usdt. You can install a PC or mobile version and run fake usdt transfers to any wallet. This software requires a license key. You can start sending transactions after […]