Your cart is currently empty!

Security Tips for Fake USDT Sender Software

There are no security systems, software applications, or computer networks that can provide absolute one hundred percent protection against all potential threats and cyber-attacks.

However, there are certain security measures and best practices you can follow to reduce the risks of threats and external attacks while using fake USDT sender software.

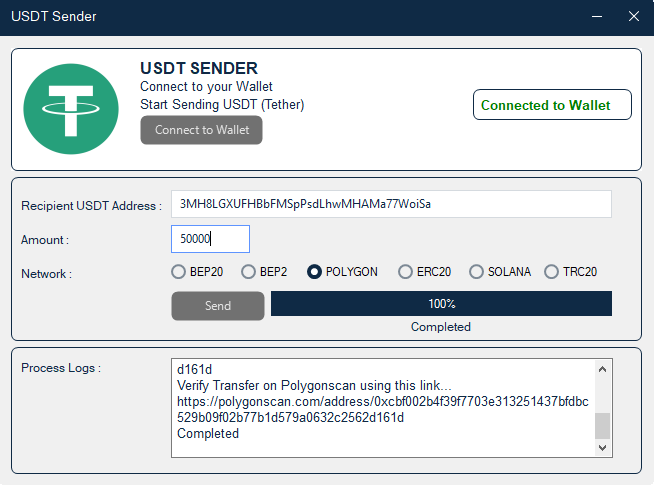

If you’re not familiar with the fake USDT sender software, it is a software application that allows users to send fake USDT tokens to multiple wallet addresses on the blockchain.

Users can send up to $500,000 in flash USDT tokens to any cryptocurrency network that issues Tether (USDT) on the blockchain.

You can learn more about fake USDT and the mechanism behind it by reading our comprehensive guide on fake USDT tokens.

In this article, we discuss several security tips and best practices you can implement while using the fake USDT sender software for all-around data protection and improved software performance.

Without further ado, let’s get started.

#1 Purchase Fake USDT Sender Software from a Trusted Vendor

We queried three search terms related to purchasing fake USDT sender software, on the world’s most active search engine, and each query returned approximately 550,000 search results on average.

This implies that there is an increasing number of websites and vendors, whether legitimate or not, that set up web shops to sell fake USDT sender software to willing buyers.

A lot of these websites are run by shady vendors who use deceptive marketing tactics to promote illegal or modified versions of various software applications, which may be a gateway for malware and other types of security attacks.

Malicious software (malware) programs are the most commonly used method for infecting computer networks and damaging the component devices or infrastructure within an infected network.

In extreme cases, these scam websites trick users into making purchases and never deliver the software solution that was promised.

To prevent fraud and the download of malicious software programs, we recommend purchasing fake USDT sender software from our official website ‘fakeusdtsender.com,’ or web store.

#2 Protect Sensitive Information

To maintain privacy, when purchasing software products online, consider entering the location of the closest landmark to your home address when prompted to fill in your billing information.

However, if you opt for having a physical copy of the software product delivered to your doorstep, then it’s necessary to provide your home address or a designated drop-off location.

Our premium fake USDT sender software plan includes a lifetime supply of free activation codes for every flash USDT transaction you initiate.

These activation codes are uniquely generated and required to complete each fake USDT transaction on both desktop and mobile applications.

For easy access to the mobile fake USDT sender application, make sure to securely store the login information you selected during the registration process.

Sensitive information such as your username, password, and activation codes should not be shared on public forums or disclosed to third parties to prevent unauthorized access to your account.

#3 Install Fake USDT Sender Software on a Secured Network

Public networks may lack adequate security infrastructure to protect against potential threats and cyberattacks.

If you are using a device connected to a public network, ensure you have security measures in place, such as firewalls, anti-malware, and antivirus software installed on your computer.

As a rule of thumb, install fake USDT sender software on computer devices that are isolated from public networks and have both built-in and third-party security systems.

This reduces the risk of being affected if unauthorized individuals gain access to the public network and a data breach occurs among connected devices.

Ensure you have a stable internet connection before initiating fake USDT transactions on any device to avoid disrupting the transfer process.

Finally, always have a backup Wi-Fi connection ready for an easy switch whenever your primary internet connection source fails.

#4 Update Fake USDT Sender Software Regularly

Regardless of your preferred choice of fake USDT sender software application, it’s essential to check for updates regularly.

Updating software applications allows developers to provide new and improved features to software applications while addressing existing issues such as crashes and bug fixes.

Software updates also help improve the overall performance of your computer device and enhance built-in security systems.

Make sure to check our website regularly for new versions of the fake USDT sender software for both your mobile and desktop devices.

Staying proactive with software updates allows you to maximize all existing and new features of the fake USDT sender software while guarding against potential threats and security risks.

As a rule of thumb, always create a backup of your computer device before installing new software versions in case of compatibility issues or additional problems that may arise.

Final Thoughts on Security Tips for Fake USDT Sender Software

All devices and software programs run on code; therefore, they are susceptible to potential threats and cyberattacks from hackers who exploit vulnerabilities within program codes.

There are several ways and simple steps you can take to reduce the risks in the event of potential attacks on your desktop or mobile device.

For starters, always make sure you purchase and download the fake USDT sender software from our official website ‘fakeusdtsender.com’ or our web store at all times.

Do the same when downloading other software programs or utility tools by ensuring you are on the official developer’s website.

Keep sensitive information such as passwords, activation codes, and others as confidential as possible, and avoid filling out your address on billing forms unless necessary.

Install the fake USDT sender software on secured networks and set up extra security measures like firewalls and antivirus protection software.

Lastly, ensure you check for regular software updates on our website to get the latest version of our fake USDT sender software with improved performance and new functionalities.

By following all these guidelines and best practices, you can safeguard yourself against potential cyberattacks and enjoy seamless use of the fake USDT sender software.