Your cart is currently empty!

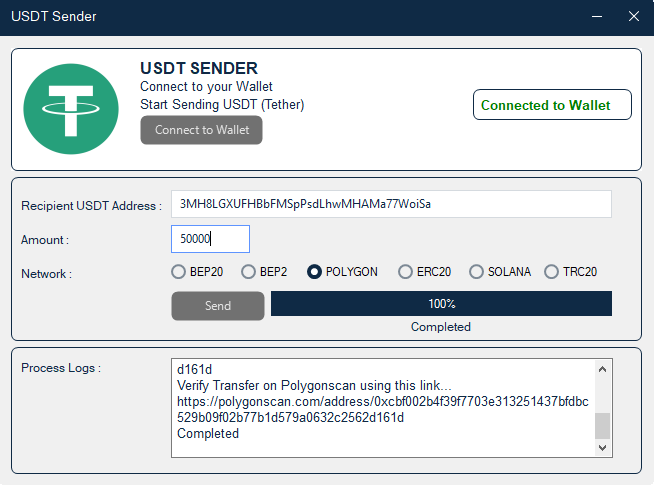

Flash USDT Sender Software Review and User Guide

Sending flash USDT tokens across the cryptocurrency ecosystem has never been easier and better.

With Flash USDT Sender Software, fake USDT tokens can be sent at lightning-fast speeds to prominent digital wallet providers like Trust Wallet, Atomic Wallet, and Binance Exchange.

If you’re not familiar with Flash USDT, it is a centralized token that mimics typical Tether (USDT) transactions on the blockchain and appears as fake USDT tokens at designated wallet addresses.

Fake USDT tokens are designed to identify vulnerabilities within the blockchain and enable wallet providers or developers, to resolve security threats, and improve the overall safety of cryptocurrency wallets.

In this article, we delve into the key features of Flash USDT Sender Software, as well as use cases, user guides, and steps to making secured purchases.

Without further ado, let’s get started.

Features of Flash USDT Sender Software (Pros and Cons)

There are a wide variety of features that make Flash USDT sender software one of the most popular software tools for sending fake USDT tokens.

Each feature has its pros and cons but works in synergy to enable the seamless transfer of flash USDT tokens across the crypto ecosystem.

Here are some of the key features of Flash USDT sender software:

Enhanced Security Protocols with SHA-256 Encryption

Flash USDT sender software enforces strict rules and network security protocols to ensure all-around data protection and privacy for its users.

By utilizing the SHA-256 encryption protocol, which powers the blockchain, each flash USDT transaction generates a cryptographic hash.

This adds an extra layer of authentication as each transaction can be verified on the respective blockchain network explorer.

Cryptographic hashes also ensure fake USDT tokens remain in recipients’ wallet addresses for a minimum of 38 days and a maximum of 60 days.

Flash USDT sender software protects against unauthorized access; keeps user information secure and maintains anonymity in the event of potential threats or attacks.

Free Lifetime Activation Codes

With a one-time purchase of the Flash USDT sender premium software package, users are guaranteed a lifetime supply of activation codes to complete each transaction.

The basic software package plan includes the Flash USDT sender software as a standalone application without activation codes.

Users of the basic plan would have to make requests and purchase activation codes separately for each transaction.

In addition to free lifetime activation codes, subscribers to the Flash USDT sender premium software package also enjoy personalized plans and seamless customer support services.

Convenient Multi-Device Access

Earlier versions of the Flash USDT sender software were limited to users of specific laptops and desktop computers.

Users with minimal knowledge of computer devices were challenged by the hardware specifications and processing power requirements needed to run older versions.

However, current versions of the Flash USDT sender provide both desktop and mobile applications compatible with a broader range of devices.

Users can now send fake USDT tokens conveniently from any device, anywhere and everywhere, across multiple cryptocurrency wallets.

Seamless Integration with Multiple Cryptocurrency Wallets

Flash USDT sender software supports seamless integration with both custodial and non-custodial cryptocurrency wallet providers.

This allows for instant deposits of fake USDT tokens into over 40 digital wallet service providers, including Binance, Atomic Wallet, and Trust Wallet.

Blockchain-Verified Transactions

Fake USDT tokens sent from the Flash USDT sender software generate a cryptographic hash that validates the integrity of each transaction on the blockchain.

Any cryptocurrency network that issues Tether (USDT) tokens on the blockchain (OMNI network, TRC-20 network, and ERC-20 network) can support fake USDT transactions.

Successful transactions can be verified on the Etherscan or any respective blockchain network explorer to which fake USDT gets sent.

Flash USDT Sender Transaction Limits

Regardless of the number of transactions completed, the total amount of fake USDT tokens that can be transferred is limited to a minimum of $350 and a maximum of $500,000 per day.

Staying within specified transfer limits prevents overload, and system crashes, and ensures the smooth operation of the flash USDT sender software.

Steps to Purchase the Flash USDT Sender Software

Here are four simple steps to purchase our Flash USDT Sender Software.

Step One: Ensure that you’re on our official website or shop page by checking for “fakeusdtsender.com” in your browser’s tab.

Step Two: Navigate to our shop page, select “Fake Tether USDT Sender Software + Activation Code,” and add it to your cart.

Step Three: Review your cart to ensure you’ve selected the correct software product package, then proceed to checkout.

Step Four: On the checkout page, fill in your billing details and place your order for the flash USDT sender software.

Quick Tip: We recommend purchasing the premium software package, which includes a lifetime supply of free activation codes, for a seamless experience with our Flash USDT sender software.

We’ve also integrated Bitcoin (BTC) and Tether (USDT) payment gateways on our checkout page for a fast and easy purchase of our wide range of software solutions.

User Guide – How to Setup the Flash USDT Sender Software

Whether you’re a non-techie or a computer wizard, setting up the flash USDT sender software requires zero technical skills.

After completing the software purchase, a zip file will automatically download, which contains the flash USDT sender software application and transfer activation codes.

Unzip the downloaded file using WinRAR or any preferred plugin of your choice to reveal its contents.

Click on the Flash USDT sender application file with the ‘.exe extension’ and follow the prompts to install the software on your computer device.

Upon successful installation of the flash USDT sender software, launch the application and follow the instructions on how to send fake USDT tokens.

Quick Tip: We recommend having a stable internet connection while working with the flash USDT sender software and maintaining the daily transaction limits for fake USDT tokens at all times.

Final Thoughts on Flash USDT Sender Software

Through years of continuous research and development, we have developed flash USDT tokens as a means to detect and resolve vulnerabilities within the blockchain ecosystem.

Fake USDT tokens enable digital wallet providers to identify potential threats and implement solutions to enhance the overall security of cryptocurrency wallets.

Using our proprietary Flash USDT sender software, fake USDT tokens can be seamlessly transferred across 40 different crypto wallets.

Users can initiate flash USDT transactions from multiple devices and easily verify transactions on various blockchain network explorers at their convenience.

Our proprietary software also utilizes advanced security protocols to offer comprehensive user protection and data privacy.

To purchase our Flash USDT Sender Software, please visit our official store and follow the instructions outlined in our purchase guidelines and installation steps provided above.